Do slower payment options really help consumers avoid fees? As consumer demand for faster payments continues to surge, instant disbursement has surged in popularity. The FedNow initiative has further solidified this trend, highlighting the potential of real-time payout solutions. The Disbursements Satisfaction Report 2023: Instant Payouts Reach an Inflection Point dives into the US disbursements landscape, analyzing the various forms of payment 2,300 consumers received throughout a one-year period. Despite the plethora of opportunities, instant payment adoption has remained largely stagnant as many issuers have yet to offer these options to their customers. According to PYMNTS-Ingo Money research, consumer hesitation is another contributing factor to the lack of adoption. Security concerns are at the heart of the issue, as individuals are reluctant to share financial data necessary for real-time payouts. Privacy worries seem to be the main motivating factor behind this decision, alongside trust and banking institution reservations. By addressing these core trepidations, we could unlock a world of opportunities with instant payments.

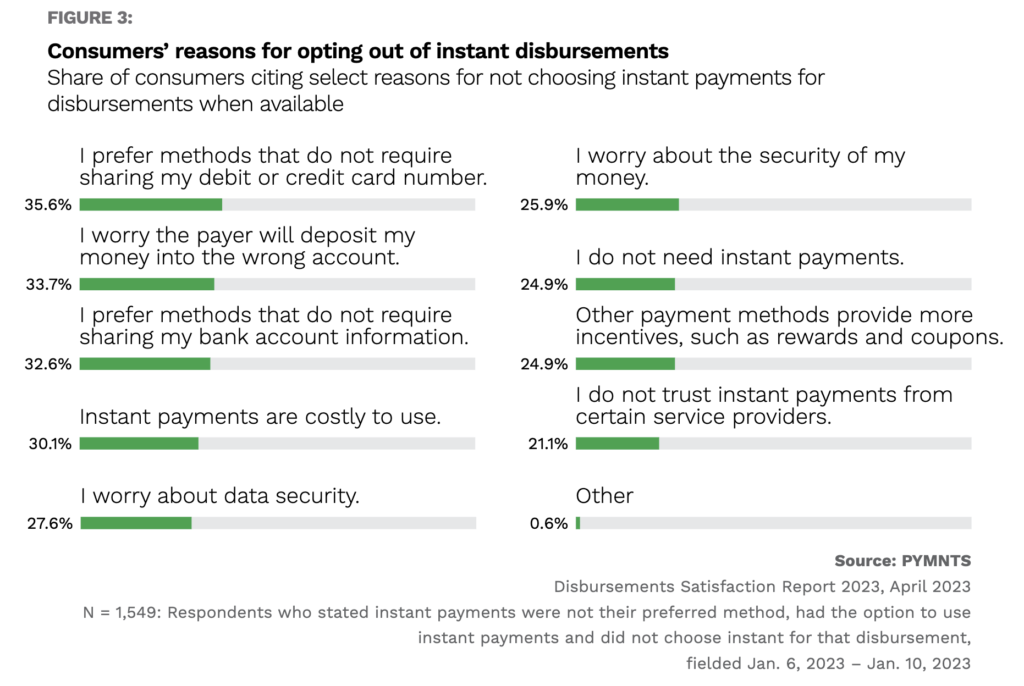

For those gifted with access to instant disbursements, yet reluctant to leverage them, privacy is paramount—36% not wanting to share debit or credit card info and 33% favoring approaches that don’t require divulging bank details. Understandably, 34% also dread the potential of transferring funds into the wrong account, whilst 26% and 21%, respectively, worry that their money might not be safe, or distrust certain providers. Even for those otherwise enamored by instant payments, a fee is often too big of an obstacle—with 30% of this demographic preferring alternative methods in order to scrimp on cost. Clearly, trial and trepidation concerning security and affordability impede the mass adoption of instant disbursements.