As modern shoppers continually strive for convenience and flexibility in their payment methods, buy now, pay later (BNPL) solutions have seen remarkable growth across the retail landscape. A study recently undertaken by PYMNTS Intelligence and Sezzle surveyed over 3,100 consumers to garner insight into this burgeoning trend—highlighting the surging popularity of BNPL as a credit option, and the varied reasons why consumers are increasingly selecting it over traditional payment modes.

The findings revealed that many shoppers prioritize BNPL services, with almost half stating they’d delay, or even forgo, an entire purchase if this payment method wasn’t available. This sentiment was echoed across all generations, including millennials, Gen Zers, baby boomers, and seniors alike. Evidently, BNPL is becoming essential in facilitating cheaper and easier purchases and offers shoppers the opportunity to build better credit profiles. Thus, it is no surprise that this open credit accessibility concept has skyrocketed in popularity and continues to revolutionize the way people shop.

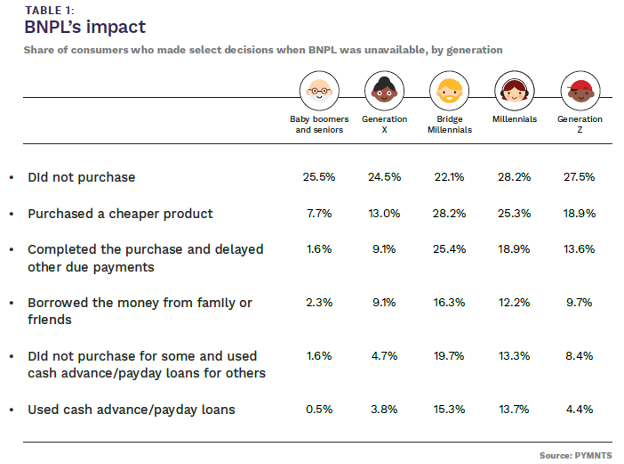

The power of BNPL lies in its ability to shape shopping decisions. A PYMNTS Intelligence study revealed that when BNPL wasn’t offered at checkout, 28% of bridge millennials would opt for a cheaper alternative—demonstrating that offering this payment option can result in increased sales of higher-value products, as consumers are less likely to settle for less. But it doesn’t stop there. The absence of BNPL can also affect consumer behavior beyond a single purchase; research shows that some shoppers may restrict themselves to one purchase or delay other payments if BNPL is not an option. This was of particular interest among bridge millennials, who were twice as likely than the average shopper to take such actions. Clearly then, providing BNPL can have a considerable impact on spending patterns and should be seriously considered by businesses keen to drive purchases and maximize profits.